Merrily, we roll along.

Data released this morning support the sense that the U.S. economy remains buoyant. We wonder though.

Let’s get to the headline: the U.S. Census Bureau reported that retail sales rose 0.3% in December and up 5.8% from December 2018.

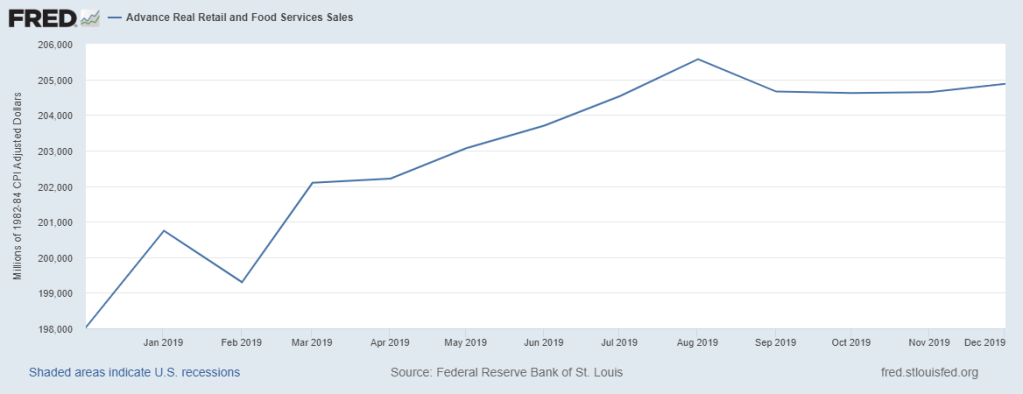

It is curious to us, though, that the headline figure from the Census Bureau is adjusted for seasonal variation but not inflation. Using the consumer price index as a deflator, the St. Louis Fed figures show just a 0.1% increase in retail sales in December from the previous month and up just 3.5% year over year.

Some details from the retail sales data worthy of note:

- Nonstore retailers (read on-line) garnered the highest sales figure of all categories excluding autos, posting $66.765 billion in seasonally adjusted sales, compared with $66.635 billion in November, an increase of about 2%. For the year, nonstore retailers had sales of $778.374 billion, up 13.1%.

- Department stores continued to lag, with seasonally adjusted sales of $10.936 billion vs. $11.019 billion in November, down about 0.8%. For the year, department stores saw a 5.5% decline in sales.

Meanwhile, the Department of Labor said initial claims for jobless benefits fell 10,000 to 204,000, the fifth straight week of declines and reinforcing the sense that if you want a job you can get one.